how to find out why i have a tax levy

11 Votes Call the number on your billing notice or individuals may contact the IRS at 1-800-829-1040. Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time.

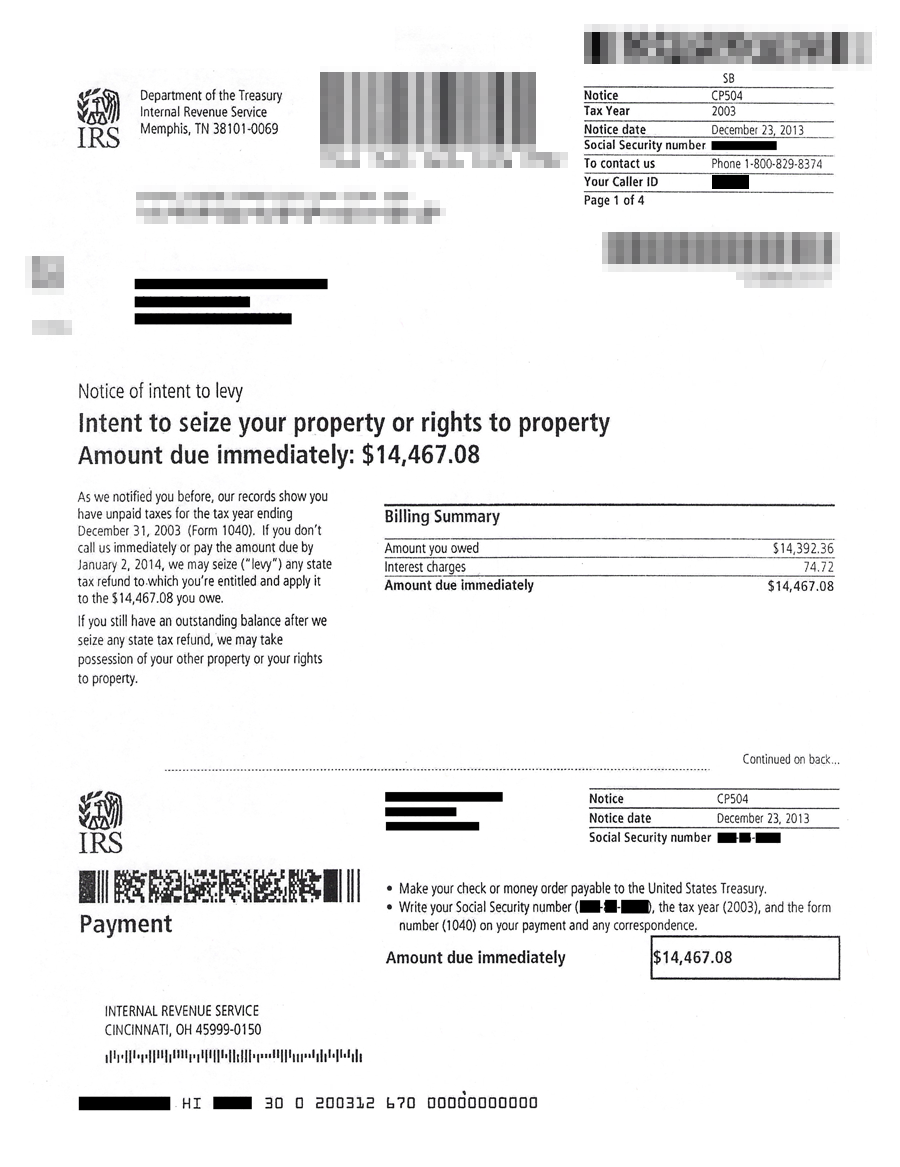

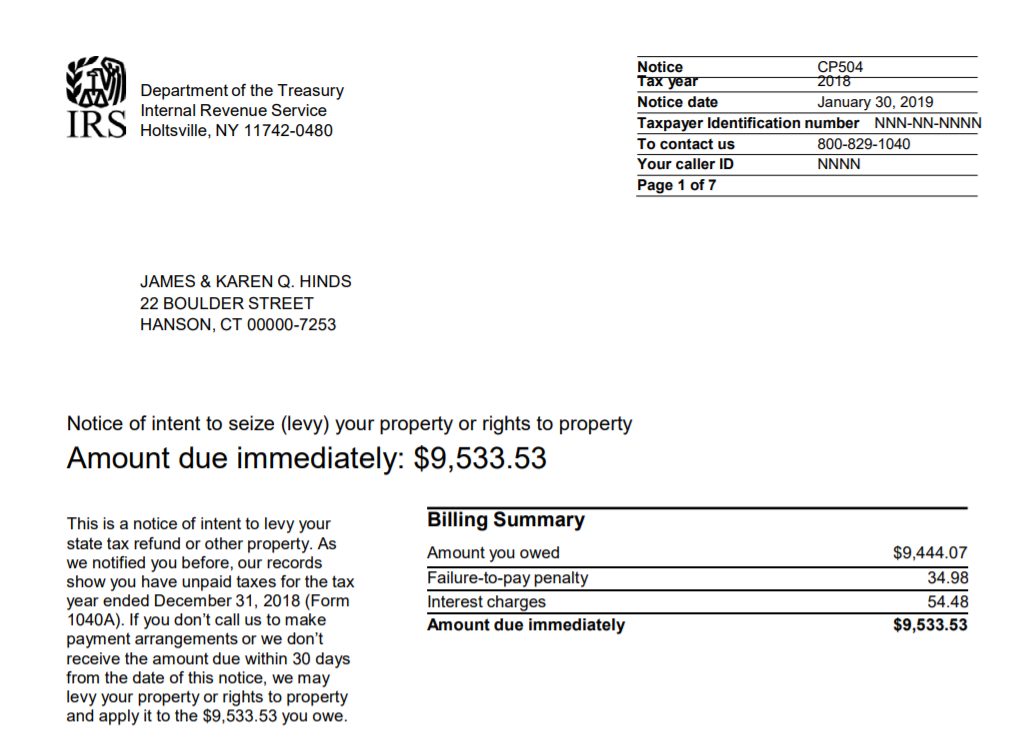

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

A tax levy itself is a legal means of seizing taxpayer assets in lieu of previous taxes owed.

. Your outstanding amount due for every tax year with a balance. Begin a tax lien search by entering your name and find out if you have any tax liens against you. A tax levy is the seizure of property to pay taxes owed.

Ad Reduce The Stress And Minimize Your Tax Obligations With Tax Services From A Paro Expert. A tax levy is not the. Up to two years of tax payment history.

There are three things the IRS wants if you owe them back taxes and not providing those three items usually results in the IRS levying. The IRS could seize the funds or your property. IRS Levies Expert Can Help.

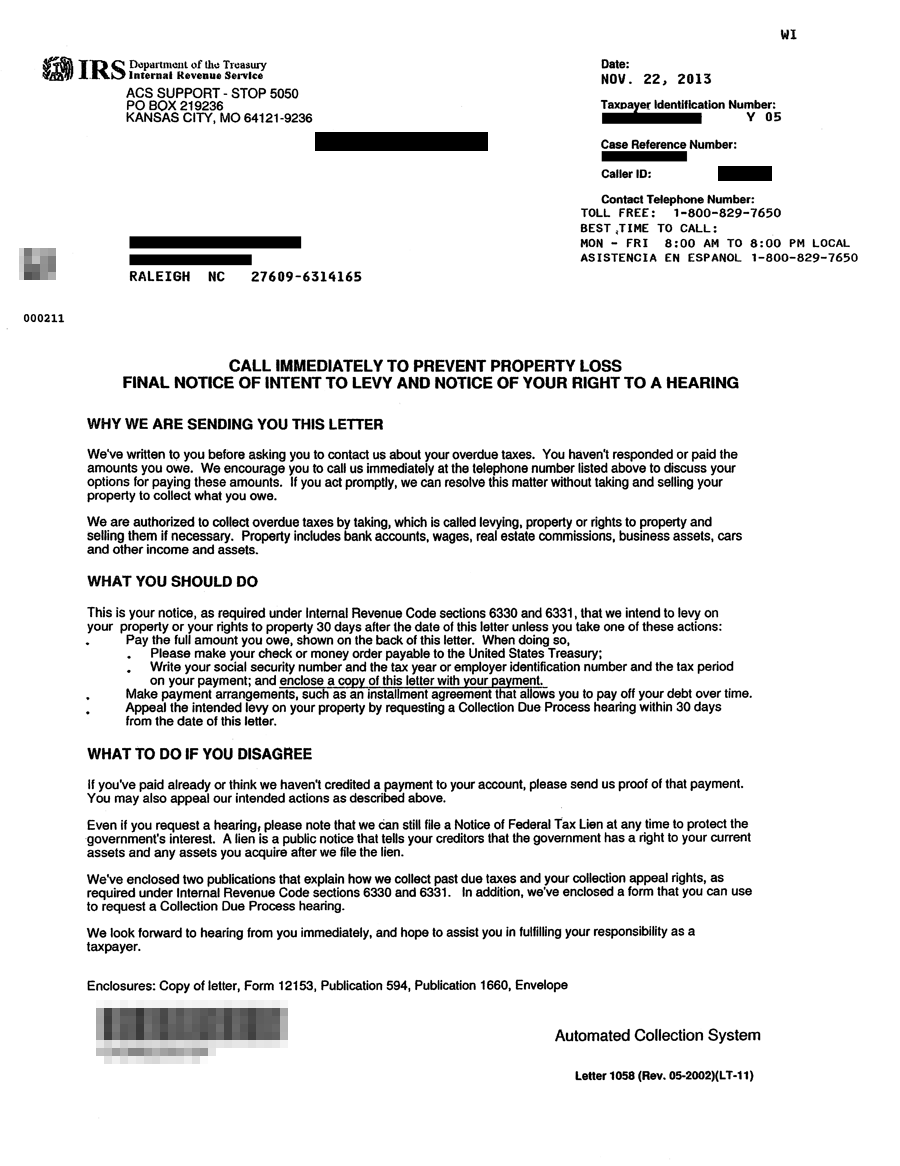

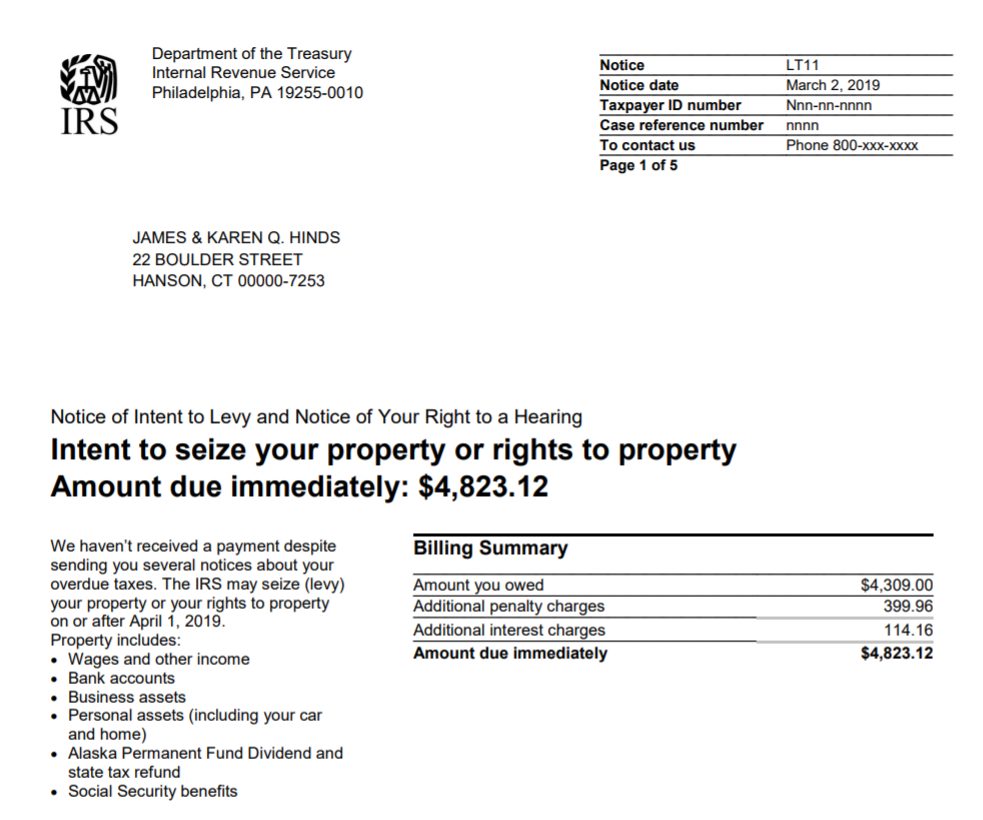

It can garnish wages take money in your bank or other financial account seize and sell your. If you receive a document titled Final Notice of Intent to Levy and Notice of Your Right to a Hearing a tax levy may be imminent. Ad Apply for tax levy help now.

Accessing your online account is by far the easiest way to. Learn How to Find Out if You Have a Tax Lien. 435 86 Views.

Ad Stop Tax Levy. Get Free Consult Quote. And the more you earn the more likely you are to be audited.

Find out what you need to do to resolve your tax liability and to request a levy release. I wanna know before I do next years taxes so I can pay it. Contact the IRS immediately to resolve your tax liability and request a levy release.

A tax levy can involve garnishing wages or seizing assets. The IRS uses a tax lien to secure that you pay off what you owe. Get A Free IRS Tax Levy Consultation.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. Here is what the IRS wants. The IRS can also.

Some items cant be seized. A property tax levy is different from a tax lien as the lien is only a legal claim against your assets. Dont Face the IRS Alone.

Immediate Permanent Solutions. Businesses may contact us at 1-800-829-4933. You should also request a credit report as soon as possible from all credit reporting agencies right away.

A state tax levy is a collection method that tax authorities use. Get free competing quotes from leading IRS tax levy experts. The IRS carries out audits of tax returns to ensure that people are honestly paying the correct amount of tax.

Trusted Affordable Reliable Professionals That Can Stop Your Tax Levy Today. You may find a reference to wage garnishment which was overlooked.

Levies Taxpayer Advocate Service

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Irs Tax Notices Explained Landmark Tax Group

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

3 Things You Should Do Immediately When The Irs Sends You Notice Of Intent To Levy Tony Ramos Law

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

What Is A Tax Lien Credit Karma Tax

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block